Figure payroll taxes calculator

First all contributions and earnings to your 401k are tax-deferred. Payroll offices and human resource departments are responsible only for processing the Form.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Find Child Care Babysitters Senior Care Pet Care and.

. Look at line 5a of your previous years Schedule A. When you work at a job a part of your income is taken each pay period based on a number of factors including your total pay how often you get checks and how many allowances you take when you fill out your W-4 at the beginning of your time at the jobPayroll taxes can be. The IRS wants you to indicate by checking the box at line 5a if youre deducting sales taxes rather than income taxes and theres no correlation between taking a sales tax deduction and your state tax refund.

A word of warning. Whether you deduct your officestudio on your taxes or not the costs are real and should be accounted for in this calculator. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The fraction is the number of days of foreign residence during the year 90 January 1 to March 31 2021 equals 90 days divided by the number of days in the year 365. If your health insurance premiums and retirement savings are deducted from your paycheck automatically then those deductions combined with payroll taxes can result in paychecks well below what you would get otherwise. Payroll tax deductions are a part of the way income taxes are collected in the US.

Your refund isnt taxable if the box there is checked. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. For daily weekly biweekly semimonthly or monthly pay schedules.

It provides you with two important advantages. In 2020 an executive memo was released allowing employers to defer payroll taxes for employees. You figure the part of the moving expense reimbursement for services performed in the foreign country for 2021 by multiplying the total includible reimbursement by a fraction.

We definitely dont think payroll taxes are easy but we do want to make it as easy as possible for you so weve designed a nifty payroll calculator that can figure out all of the federal and Louisiana state payroll taxes for you and your employees. Gross wages are the total amount of money your employee earned during the current pay period. Payroll Deduction Calculator will quickly calculate deductions for you.

2016-55 Wages salaries tips etc. Heres how it works and what tax rates youll need to apply. It can also be used to help fill steps 3 and 4 of a W-4 form.

This number is the gross pay per pay period. The steps our calculator uses to figure out each employees paycheck are pretty simple but there are a lot of them. This paycheck calculator can help you do the math for all your employee and employer payroll taxes and free you up to do what you do best.

For amount to withhold see tax tables in IRS Publication 15 Employers Tax Guide. Skip To The Main Content. Get 247 customer support help when you place a homework help service order with us.

If sifting through timesheets calculating withholdings and sorting out deductions seem to take longer than the Cubs took to win their last World Series today is your lucky day. Use only to figure 2017 estimates. When you hop over to Publication 15-T youll notice that the IRS lists more than just two tablesInstead it lists tables for manual or automated payroll calculations.

Such expenses include rent mortgage payments real estate taxes fees to your homeowners association homeowners or renters insurance security fees such as alarms home maintenance etc. You only pay taxes on contributions and earnings when the money is withdrawn. How Income Taxes Are Calculated.

Do not use these tax rate schedules to figure 2016 taxes. Employers withhold income taxes from employee paychecks. SurePayrolls free payroll tax calculator helps small business owners easily calculate payroll taxes for DIY payroll.

All you have to do is input wage and W-4 information for each employee into the calculator. For single people married people or people filing as the head of household. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Referring client will receive a 20 gift card for each valid new client referred limit two. Free 2022 Employee Payroll Deductions Calculator. Payroll taxes are part of the reason your take-home pay is different from your salary.

A 401k can be one of your best tools for creating a secure retirement. 2016-55 Wages salaries tips etc. If your taxes are over-withheld use the withholding calculator to find the right number of allowances that will leave you with more money in each paycheck while still making sure that enough is withheld to cover your tax when you file your return.

Figure out each employees gross wages. Federal income taxes employee paid. Lets go over federal payroll taxes first.

Send amounts withheld to the IRS electronically using EFTPS. Our calculator will figure out your gross pay net pay and deductions for both Florida and Federal taxes. With over 1000000 small businesses in Illinois youre not the first one trying to figure out payroll taxes.

Payroll Tax Definition. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Simply enter wage and W-4 information for each employee.

When you start a new job and fill. Subtract any deductions and payroll taxes from the gross pay to get net pay. Federal Payroll Tax Rates.

Referred client must have taxes prepared by 4102018. Click to see what payroll deductions changes will do to your next paycheck for free. This calculator is intended for use by US.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Your household income location filing status and number of personal exemptions. Our New York payroll calculator can also help you figure out the federal payroll tax withholding for both your employees and your business.

Additionally IRS Notice 2020-65 allows employers to defer. And for employees who submitted pre-2020. Of course New York taxes are just part of the total tax equation.

Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an HR Block or Block Advisors office and paid for that tax preparation. Withholding amount is based on each employees total wages and the latest IRS Form W-4 the employee completed. The PaycheckCity salary calculator will do the calculating for you.

Second many employers provide matching contributions to your 401k account. Do not use these tax rate schedules to figure 2016 taxes. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Employers who chose to defer deposits of their share of Social Security tax were required to pay 50 of the eligible deferred amount by December 31 2021 and the remaining amount by December 31 2022. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Dont want to calculate this by hand. Below is a summary of everything that goes into calculating the payroll tax for a New York. Heres how it works.

Use only to figure 2017 estimates. This is your total taxable.

Paycheck Calculator Take Home Pay Calculator

Enerpize The Ultimate Cheat Sheet On Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Payroll Taxes Methods Examples More

Social Security Tax Calculation Payroll Tax Withholdings Youtube

Paycheck Calculator Take Home Pay Calculator

How To Calculate 2019 Federal Income Withhold Manually

Solved W2 Box 1 Not Calculating Correctly

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Payroll Tax Calculator For Employers Gusto

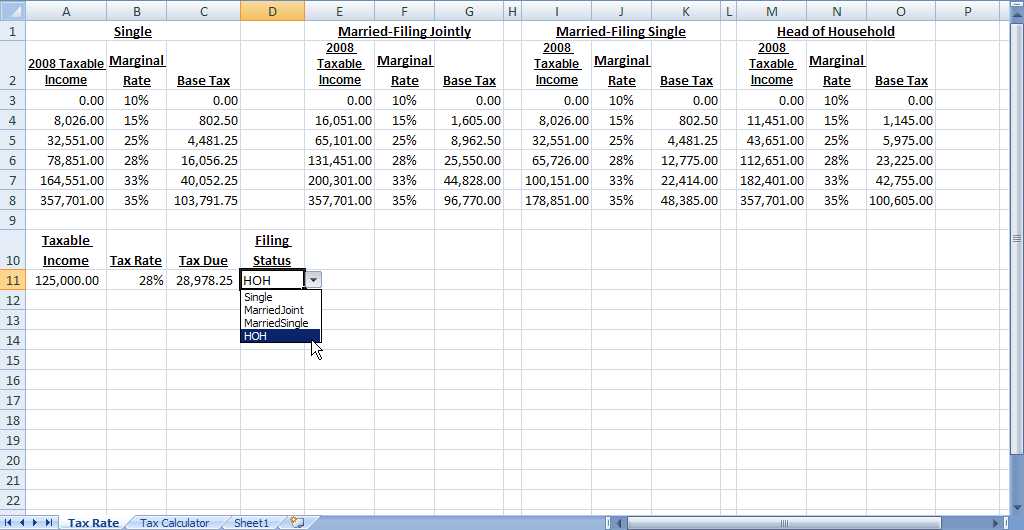

Build A Dynamic Income Tax Calculator Part 2 Of 2 Davidringstrom Com

How To Calculate Federal Income Tax

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022